De Beers To Cease Production Of Lab-Grown Diamonds for Jewelry

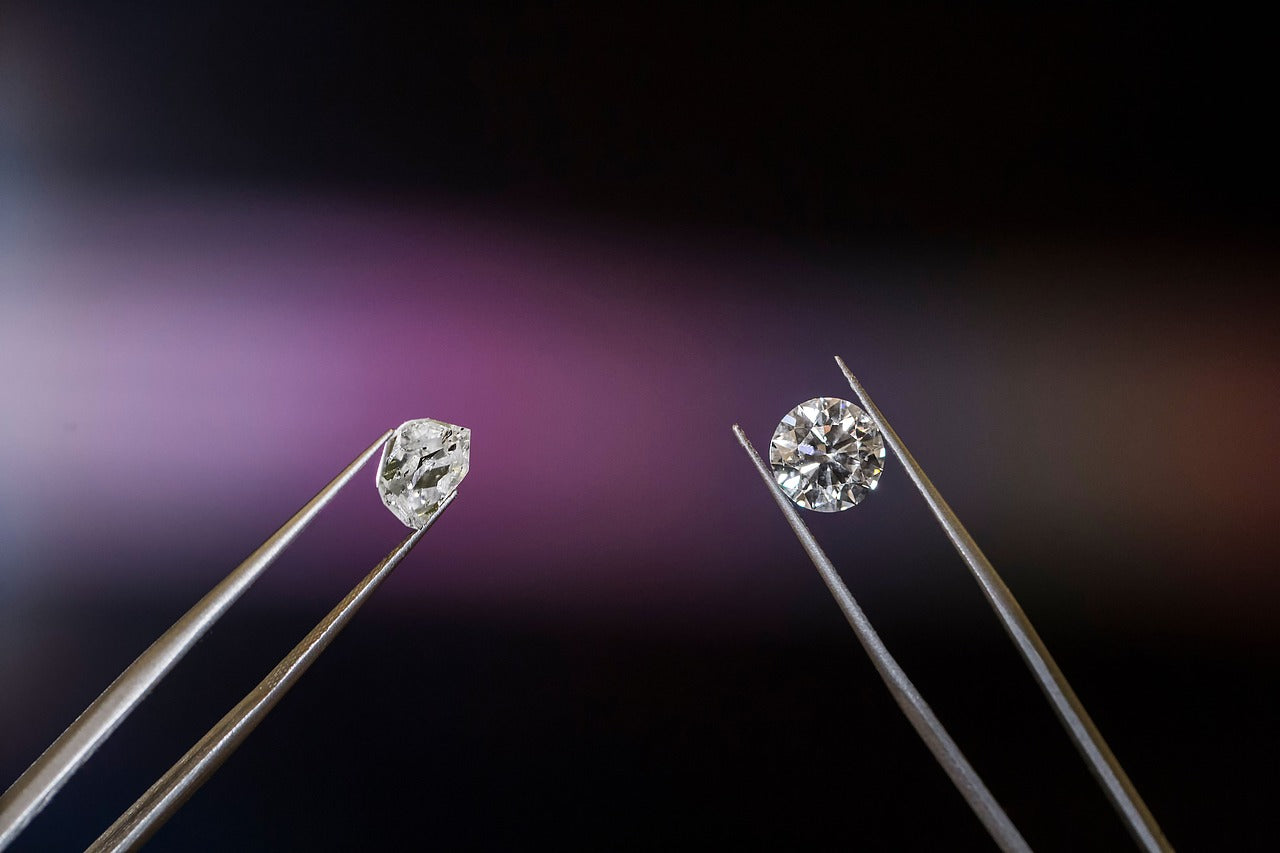

Despite possessing the technology to create synthetic gems, De Beers had long avoided selling them as jewelry, fearing they would diminish the value of natural diamonds.

However, as synthetic stones gained popularity and began to compete with natural diamonds, De Beers introduced its own brand in 2018.

Lightbox

The company launched Lightbox to offer synthetic diamonds at lower prices than its competitors, aiming to drive prices down and create a clear distinction for consumers.

Picture Source: Pixabay

Now, De Beers is discontinuing this line as CEO Al Cook restructures the company, which is poised to separate from its parent company, Anglo American Plc.

This decision is part of a broader strategy to fend off a potential acquisition by BHP Group. Last month, Anglo-American announced plans to either sell or separate De Beers, ending a nearly century-long partnership with the iconic diamond brand.

As De Beers prepares for this transition, it will refocus on promoting natural diamonds.

While synthetic diamond prices have dropped, it remains debatable whether this is primarily due to De Beers' actions or an influx of new supply.

De Beers will not immediately cease sales of Lightbox stones. The company plans to sell its existing inventory over the next year before deciding the future of the business.

Industry experts remain divided on the long-term impact of synthetic diamonds and whether the current downturn in the diamond market is cyclical or represents a structural change driven by lab-grown alternatives.

Moving forward, De Beers will focus on category marketing, promoting diamond jewelry as a whole rather than just its own brands.

It also plans to expand its retail presence and explore polishing its own stones, an area traditionally dominated by family-run firms in India and Belgium.

De Beers aims for an annual core profit of $1.5 billion by 2028. Last year, the company's profit was $72 million, though historically, its profits have ranged from $500 million to $1.5 billion, fluctuating with the diamond market's boom-and-bust cycles.